Get This Report on Mortgage Broker Job Description

Wiki Article

Everything about Mortgage Brokerage

Table of ContentsMortgage Broker Job Description - The FactsSome Of Mortgage BrokerAll About Mortgage BrokerageFacts About Mortgage Broker Average Salary RevealedThe smart Trick of Mortgage Broker Job Description That Nobody is DiscussingThe Single Strategy To Use For Mortgage Broker SalaryNot known Facts About Broker Mortgage MeaningFascination About Mortgage Broker Salary

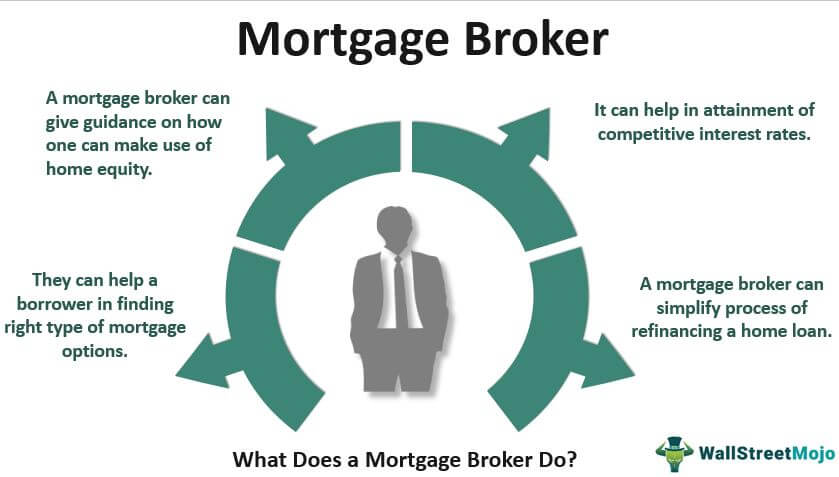

What Is a Mortgage Broker? The mortgage broker will function with both events to get the specific accepted for the funding.A home loan broker generally functions with several loan providers and also can supply a variety of lending alternatives to the debtor they deal with. What Does a Home mortgage Broker Do? A home loan broker aims to finish property purchases as a third-party intermediary between a debtor and also a lending institution. The broker will certainly accumulate information from the private and most likely to multiple loan providers in order to find the best possible financing for their client.

All About Mortgage Broker Meaning

The Bottom Line: Do I Required A Home Mortgage Broker? Working with a home mortgage broker can conserve the debtor time as well as effort throughout the application procedure, and possibly a great deal of money over the life of the loan. On top of that, some lending institutions function specifically with home mortgage brokers, indicating that borrowers would have access to financings that would or else not be readily available to them.It's critical to take a look at all the charges, both those you may need to pay the broker, as well as any fees the broker can aid you stay clear of, when weighing the decision to collaborate with a home mortgage broker.

Mortgage Broker Association - Truths

You have actually possibly listened to the term "home mortgage broker" from your realty agent or pals who have actually purchased a house. However what precisely is a home loan broker and what does one do that's different from, claim, a lending officer at a bank? Geek, Budget Overview to COVID-19Get solution to inquiries about your home loan, traveling, finances and maintaining your peace of mind.1. What is a home loan broker? A home mortgage broker functions as an intermediary in between you and also potential loan providers. The broker's work is to compare mortgage lending institutions on your behalf as well as locate rates of interest that fit your requirements - broker mortgage fees. Mortgage brokers have stables of loan providers they collaborate with, which can make your life easier.

Our Mortgage Broker Diaries

Just how does a home mortgage broker earn money? Home mortgage brokers are usually paid by loan providers, in some cases by customers, yet, by regulation, never both. That regulation the Dodd-Frank Act Restricts home mortgage brokers from charging concealed charges or basing their compensation on a consumer's passion price. You can additionally pick to pay the home loan broker on your own.The competitiveness and also home rates in your market will certainly have a hand in determining what home mortgage brokers fee. Federal regulation limits just how high payment can go. 3. What makes home loan brokers different from finance police officers? Funding police officers are staff members of one lending institution that are paid established incomes (plus incentives). Finance police officers can compose only the sorts of loans their employer picks to supply.

Mortgage Broker Vs Loan Officer Can Be Fun For Everyone

Home mortgage brokers might be able to give consumers access to a broad selection of car loan types. 4. Is a mortgage broker right for me? You can conserve time by utilizing a home loan broker; it can take hrs to get preapproval with different loan providers, then there's the back-and-forth communication involved in underwriting the lending and ensuring the purchase remains on track.When selecting any loan provider whether with a broker or directly you'll want to pay focus to lender fees." After that, take the Lending Quote you receive from each lender, position them side by side and also compare your interest price and also all of the costs as well as shutting expenses.

The 25-Second Trick For Mortgage Brokerage

Exactly how do I pick a home loan broker? The finest way is to ask pals as well as relatives for references, but make sure they have really utilized the broker and also aren't simply dropping the name of a former college mortgage broker in my area roommate or a remote acquaintance.

Mortgage Broker Assistant Job Description Things To Know Before You Buy

Competitors as well as home costs will influence how much home mortgage brokers get paid. What's the difference between a home mortgage broker and a funding policeman? Lending policemans work for one loan provider.

Mortgage Broker for Beginners

Investing in a brand-new house is among one of the most complex occasions in an individual's life. Characteristic vary considerably in regards to design, amenities, school district as well as, certainly, the constantly important "area, location, location." The home loan application procedure is a difficult element of the homebuying procedure, particularly for those without past experience.

Can figure out which issues may produce problems with broker mortgage license one loan provider versus an additional. Why some customers stay clear of home loan brokers Sometimes property buyers feel a lot more comfy going directly to a huge financial institution to secure their finance. In that instance, buyers need to this hyperlink at least talk to a broker in order to recognize every one of their choices relating to the kind of finance as well as the offered rate.

Report this wiki page